权当灌水。

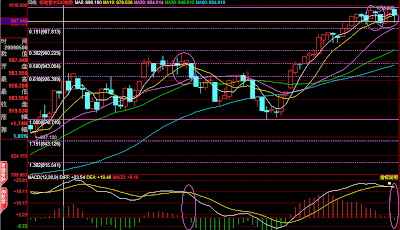

玩股也有好多年了,自己有时候也经常和自己玩预测,发现正确率一般不超过7成,中线准一些,有个八成,长线和短线都比较难准,有时候也说不出个所以然来。自己预测的水平这几年其实一直没有太大长进,但是操作越来越熟练,我想最大的原因可能还是很玄的经验在起作用。经验这个东西,就是你看到一个形态,不用去查指标,直觉就知道好还是不好。操作经验在这里作用就是消除bias,所谓牛眼看牛,熊眼看熊,一个形态解读办法有很多,经验多了潜意识里面知道是哪一种,也能战胜本能排斥这个结论的情感,做股票,最关键是战胜自己的情感。比如看到现在8点不到的法国CAC指数形态是-0.34%,我第一感觉就是走完三角形态要继续涨,一会儿看对不对。

拿这几天的形态来讲,一般新手因为刚入场而盼涨,老手因为看到了顶部形态而盼跌,最后结果如何,TA预测是可以的,但谁都不知道。市场就是走一步看一步,自己错了,其实不用先想为什么错了,而是应该采取正确的操作方式。很多人觉得操作方式其实没有正确和不正确的分别,确实如此。正确的操作方式其实就是一致的操作方式,比如自己经验证明,什么情况怎么做,正确率高,就要坚持,哪怕错了,也是正确的。这个很拗口哈,呵呵。其实就是讲,一个7成正确率的经验,市场如果出现了3成的可能,不要去轻易推翻它。一般形成这种所谓的经验和股感的,基本要2-3年的功力,很多散户2年已经外婆或深套,能活下来的少数,就成了老手。

光看股市,把握不了股市的方向。如果能看明白债券市场,期货市场和外汇市场,水平还要上一个台阶。这些市场都是关联的,几个市场分析下来结果差不多,那一般那个结果差不到哪里去。这里最重要的是数据。人类的语言是很奇妙的,所以看人写的东西是不行的。大投行的报告,一般75%的内容是chart,且其中90%的chart都是自己综合数据画的。商业银行的报告,一般75%是文字,其中90%是拷贝来的,所有的chart基本都能在bloomberg找到。最大的区别就是数据不骗人。

老实讲,玩股市玩到数据级别的,我很少见到能亏钱的。

-----------------20分钟后的分割线---------------------

现在可以基本确定我第一段的预测是错误的了。冲高后的收缩三角7成以上是要继续趋势向上,可是这次没有,那么现在就是应该做反方向的操作了,因为说明向下的动能很大。具体操作,比如现在CAC 3430这个位置,可以轻仓做空,止损位置在比今日高点略高,向下突破时候加仓做空。亏的可能是12点,赚的可能也许就是60点了。和期货市场一起看,就发现今天的commodity期货非常疲软,外汇来看,美元走强,所以也是符合这个趋势的。宏观来看,中国市场大跌,原材料基本现在是中国市场为主要定价,所以应该会跟随且放大中国市场的走势。今日沪铜沪铝全线下挫,也符合这个操作的可能。那么如果CAC刚才确实突破向上了怎么办呢?很简单,市场不明朗,不操作,等待信号。